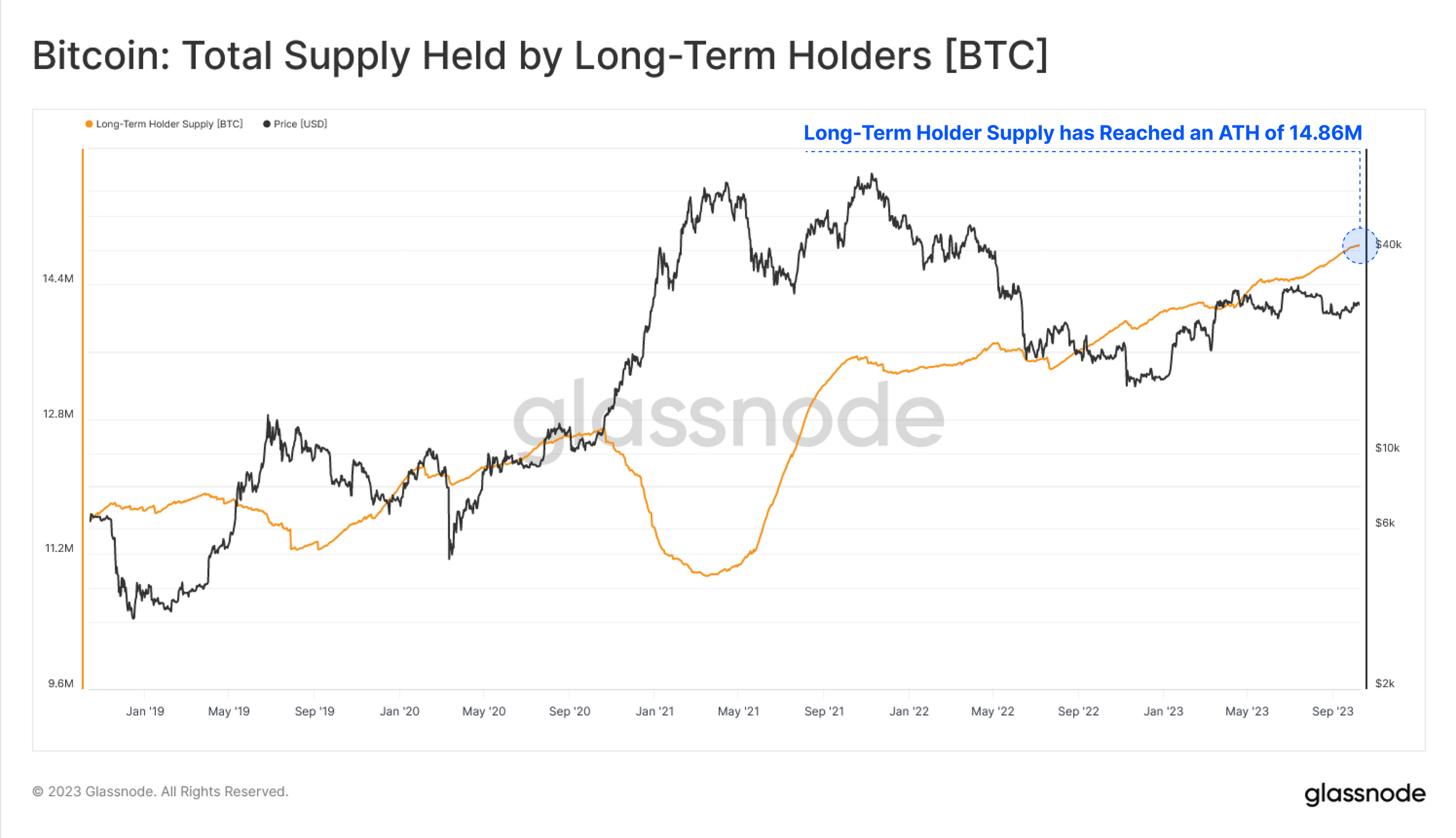

Seasoned crypto investors continue scooping up bitcoin (BTC) at a rate of 50,000 coins per month valued at $ 1.35 billion, according to blockchain analytics firm Glassnode’s latest onchain report. This supply tightening comes as the broader digital asset market remains “exceptionally dormant” both onchain and across exchanges.

Long-Term Bitcoin ‘Hodlers’ Tighten Grip Amidst Dormant Market

While Bitcoin’s price has fluctuated dramatically this year, the cohort of long-term holders or “hodlers” remains resolute, Glassnode’s latest report shows. Glassnode’s Hodler Net Position Change metric reveals these investors, specifically those holding coins for at least 155 days, are withdrawing over 50,000 BTC from exchanges each month. This data highlights both the tightening supply and reluctance among seasoned investors to transact in the current market conditions.

Glassnode notes the market has been in a state of low and contracting liquidity similar to the 2014-15 and 2018-19 bear markets, now lasting 535 days. Both the value transferred onchain and the influx of new capital into the Bitcoin network are at multi-year lows. Exchange activity also exhibits pervasive apathy among investors. The 30-day average for total exchange volume currently sits around $ 1.5 billion, a 75.5% decline from its all-time high of $ 6 billion in May 2021.

Glassnode’s researchers state:

The volume of Profit and Loss realized by coins sent to Exchange Addresses has also experienced a complete detox from the 2021-22 cycle, with both measures hitting the lowest levels seen since 2020.

Identifying Peak Altseason Regimes

To identify periods of explosive altcoin speculation, Glassnode introduced a model to assess risk-on and risk-off environments through the lens of capital rotation. Despite volatility in altcoin prices, this framework reveals capital is not currently rotating from Bitcoin through Ethereum and stablecoins at increasing rates, a hallmark of “altseason mania.”

“This model is accomplished by looking for a positive and increasing 30-day change in the ETH Realized Cap and Stablecoin Total Supply (i.e a positive second derivative),” Glassnode’s report details. “This model simulates the waterfall effect of capital rotating from larger caps, into small caps.”

Amid the wild swings in altcoin prices, Glassnode suggests these oscillations are more a result of existing low liquidity than a genuine risk-on mood. For the moment, hodlers are hungrily snapping up BTC, constricting supply in anticipation of a forthcoming bull surge. Moreover, with the next reward halving just 196 days away, we’re set to witness an even more intense squeeze on supply.

What do you think about Glassnode’s data on long-term bitcoin holders and identifying peak altseason regimes? Share your thoughts and opinions about this subject in the comments section below.

Bitcoin News

Leave a Reply

You must be logged in to post a comment.