Central banks around the world maintained their appetite for gold in the third quarter of 2023, with their purchases totaling 337 metric tons, the World Gold Council’s (WGC) third-quarter report shows. Analysts from the council suggest that this steady central bank activity is indicative of a sustained, strong demand for gold, which may lead to a strong year-end total for 2023.

World Gold Council Report Shows Central Banks Boost Gold Holdings Amid Economic Shifts

The figure of 337 metric tons of gold came close to but did not surpass the record set in the third quarter of 2022. However, it has pushed the year-to-date purchases to a record high of 800 metric tons. The WGC report states that such consistent central bank activity signals ongoing demand for gold, potentially leading to another strong year-end total for 2023.

On Friday, the price of gold per ounce reached a high of $ 2,002 but has since fallen below the $ 2,000 mark. Over the past 30 days, gold has gained more than 9% against the U.S. dollar, and it has increased 22% over the past 12 months. In the report, the WGC notes that central bank purchases have become a key driver of demand.

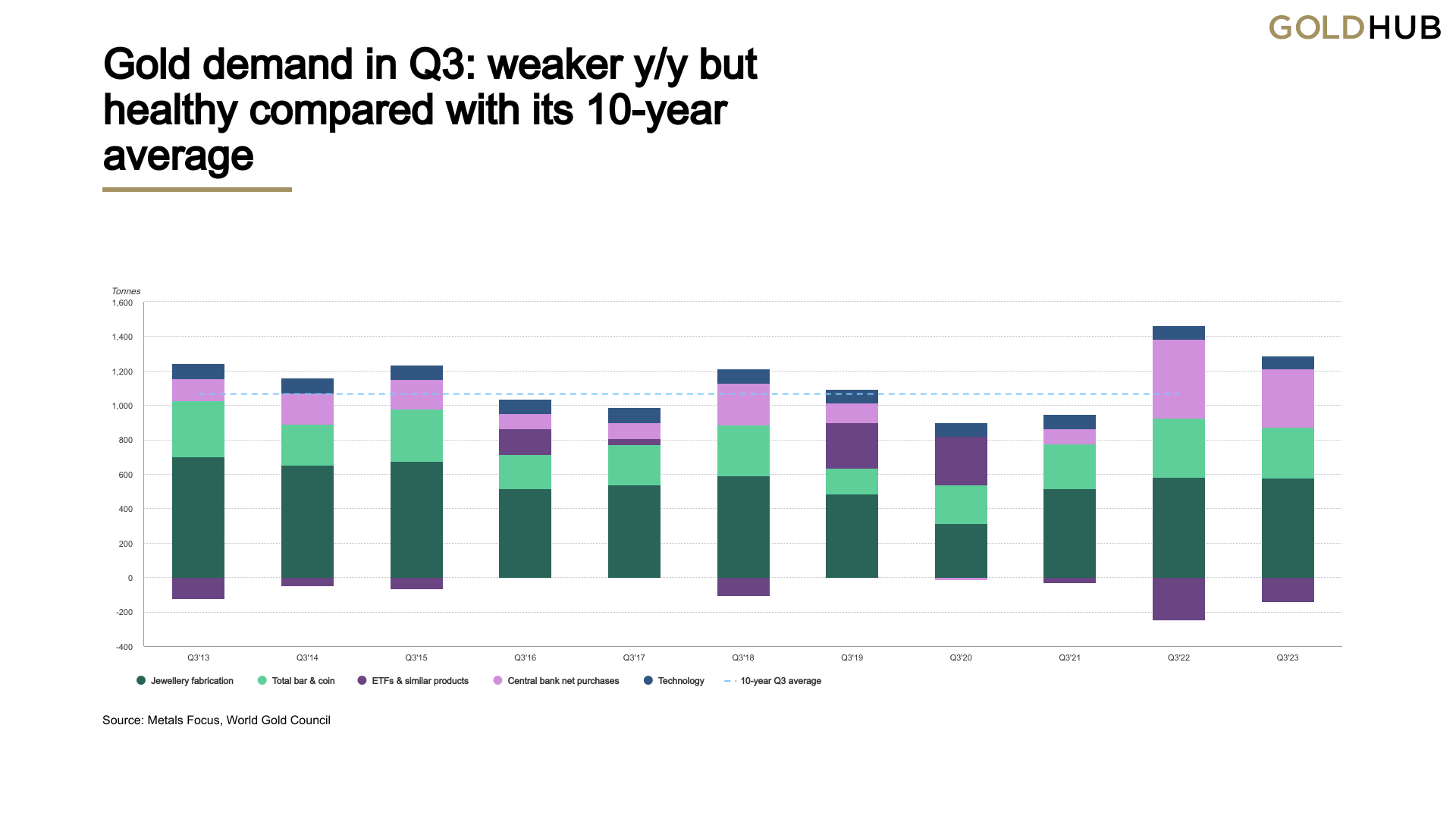

The council’s report also notes that, when excluding over-the-counter (OTC) transactions, gold demand in the third quarter exceeded its five-year average by 8%, despite a 6% year-over-year decrease, totaling 1,147 metric tons. When including OTC and stock flows, overall demand rose 6% from the previous year, reaching 1,267 metric tons.

The report goes on to say that gold investment demand in the third quarter was 157 metric tons, a 56% increase from the previous year, although it fell short of the five-year average of 315 metric tons. Gold exchange-traded funds (ETFs) around the world experienced a decrease of 139 metric tons in the third quarter, which, while notable, was less than the 244-ton outflow seen in the same quarter of the previous year.

Louise Street, the senior markets analyst at the World Gold Council, summarized the situation: “Gold demand has been resilient throughout this year, performing well against the headwinds of high interest rates and a strong U.S. dollar. Our report shows that gold demand is healthy this quarter, compared with its five-year average.”

Beginning in October 2023, against a backdrop of escalating tensions in Israel, the value of precious metals and bitcoin (BTC) has climbed amid mounting economic uncertainty. Over the last month, gold has appreciated by 9.4%, and BTC has surged 25%. Closing out this week’s trading, U.S. stocks showed resilience, finishing strong as Treasury yields retreated, with all four primary indices ending Friday in positive territory.

What do you think about the central bank gold demand in Q3 2023? Share your thoughts and opinions about this subject in the comments section below.

Bitcoin News

Leave a Reply

You must be logged in to post a comment.