With traditional commercial institutions like Visa, Mastercard, Tesla, BNY Mellon, BlackRock, Gucci and countries such as El Salvador, Central African Republic constantly expanding in the cryptocurrency field, more and more investors are starting to look at cryptocurrency with new eyes. In 2022 alone, the number of cryptocurrency users has reached 320 million, identifying a huge potential user base.

Cryptocurrency is an asset that operates on a blockchain, which has the characteristics of decentralization, peer-to-peer, transparency, and irreversibility. Therefore, cryptocurrency is also highly expected to be applied in the payment field. According to Coinbase’s cryptocurrency research report in 2021, as of June 2021, the number of merchants supporting cryptocurrency payments has reached 20 million. In addition, according to Visa’s data, in the first quarter of 2022, Visa’s payment network processed $ 2.5 billion worth of cryptocurrency transactions, up from $ 1 billion in the first quarter of 2021. It is easy to tell that crypto payments are becoming a new trend with great demand.

Advantages of Crypto Payment and Market Demand

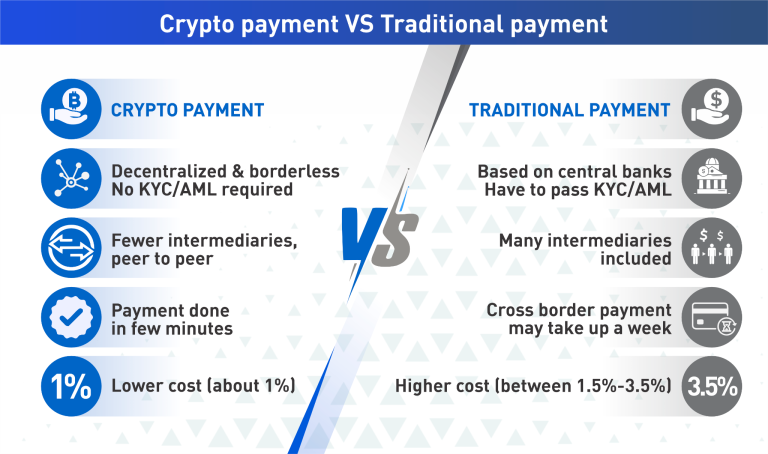

Compared with traditional payment methods, crypto payment has considerable advantages:

- Transactions conducted on-chain in a decentralized, peer-to-peer manner, enabling international transfers and payments.

- Involving fewer intermediaries and achieving faster settlement speeds (confirmed within a few minutes).

- Lower costs (compared to traditional credit cards’ fees of 1.5% to 3.5%, crypto payment fees are about 1%).

In addition to cryptocurrency investors and payment consumers, residents of areas with severe fiat inflation, such as Southeast Asia, Latin America, and Africa, also have a strong interest in holding cryptocurrency to resist inflation.

In fact, from the perspective of the cryptocurrency industry, crypto payments usually include two parts: cryptocurrency consumption payments (using cryptocurrency to purchase goods and services, and cross-border transfers are all included), and the other part is the exchange of cryptocurrency and fiat currency, which provides underlying support for the former and is also a potential new demand for various crypto payment roles.

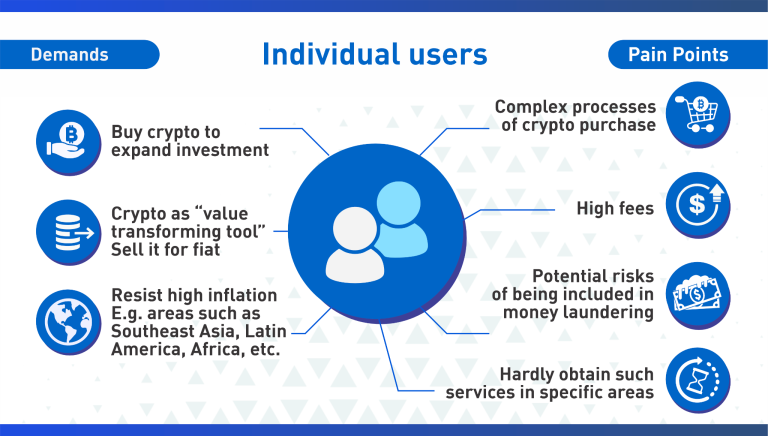

Individual user demand:

- Cryptocurrency investors usually need to use fiat currency to buy/sell cryptocurrency to expand investment or exit for cash.

- Cryptocurrency consumers usually regard cryptocurrency as a “value transfer tool” and usually exchange cryptocurrency for fiat currency upon reaching their goals.

- Users in high inflation areas like Southeast Asia, Latin America, Africa, etc. do not want to invest or pay for consumption but simply resist inflation (this part of the area is also a potential market for crypto payment business).

Market pain points:

There are high barriers to accessing cryptocurrencies, including complex processes, high fees, and potential risks of being included in money laundering. At the same time, some specific regions’ users can hardly obtain such services, such as CEX (centralized exchange) platforms, which are the main hub for buying/selling cryptocurrencies, do not serve users in some specific regions.

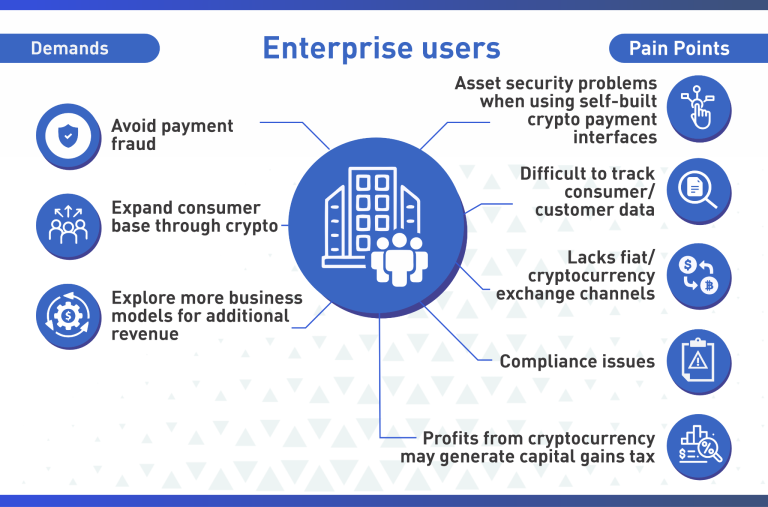

Enterprise user demand:

- Crypto payments are expected to avoid payment fraud, such as the situations that fraudsters buy goods and then refuse to return them and apply for refunds.

- Further expand the consumer base through cryptocurrency, attracting more cryptocurrency enthusiasts and investors to become their users.

- Explore more business models to obtain additional derivative income.

Market pain points:

- Self-built crypto payment interfaces may lead to asset security problems due to inherent crypto technical issues (e.g. private key leakage, etc.).

- It is difficult to track consumer/customer data, including settlement and clearing.

- The payment portal lacks fiat/cryptocurrency exchange channels, and the users for crypto payments are usually cryptocurrency investors.

- Directly building interfaces has certain compliance issues.

- Profits from cryptocurrency in some regions may generate potential capital gains tax.

- Third-party payment institutions such as Visa, Mastercard and Paypal can meet enterprises’ business needs for cryptocurrency payment and settlement, further ensuring compliance and security, but the service fee is high and lacks flexibility. For example, each third-party payment system usually has geographical restrictions and cannot meet the needs of all payers.

Crypto Gateway Products Shine in the Payment Field

Therefore, from the overall perspective of the crypto payment field, there is a new demand for both individual and enterprise users, and from the perspective of business development, individual and enterprise users are usually bound at both ends of crypto payment. Therefore, a crypto payment infrastructure can better provide related services to these two types of users, and can better promote the overall development of this field, rather than focusing on one type of user and lack of support for another type of user.

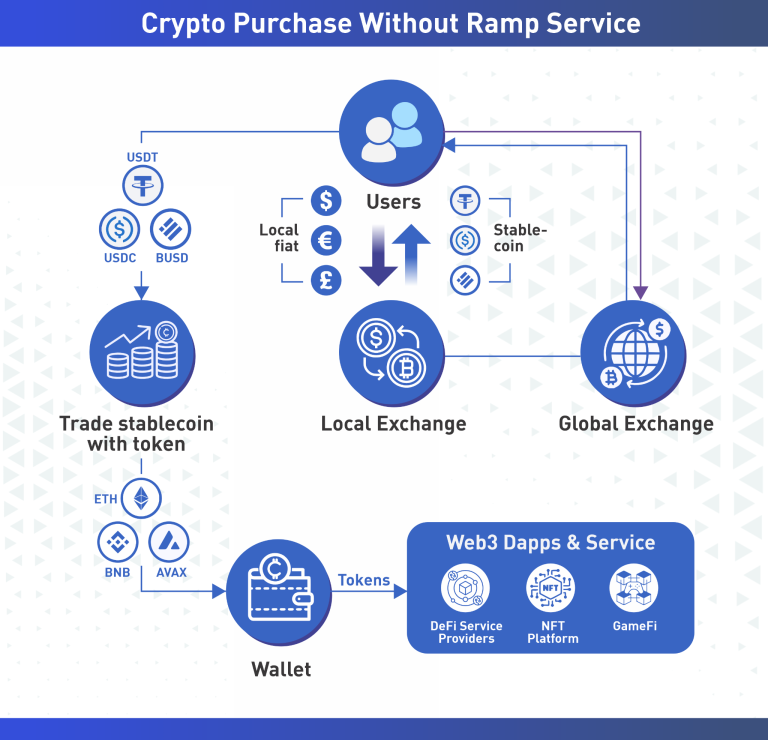

Here we can give an example. Suppose we want to purchase USDT and have three needs: paying for an online service, transferring money to overseas friends, and investing in DeFi. One approach is to go to CEX platforms such as Binance and Coinbase and purchase some USDT through OTC (over-the-counter) services, which are usually P2P matching trading services provided by CEX platforms for fiat and cryptocurrency. Then, withdraw USDT from the trading platform to different addresses to complete payments and transfers to the target address.

If cross-border remittances and payments are high-frequency behaviors of the user (such as businesses and enterprises), this means that every transaction requires confirmation from OTC merchants, fiat currency payments, and withdrawal reviews from CEX platforms, and each step requires a transaction fee.

Currently, although OTC services dominated by CEX still account for the majority of the market, the industry has also seen some crypto gateway products, which can achieve more convenient and low-threshold fiat-to-cryptocurrency exchanges through a “cross-gateway” approach.

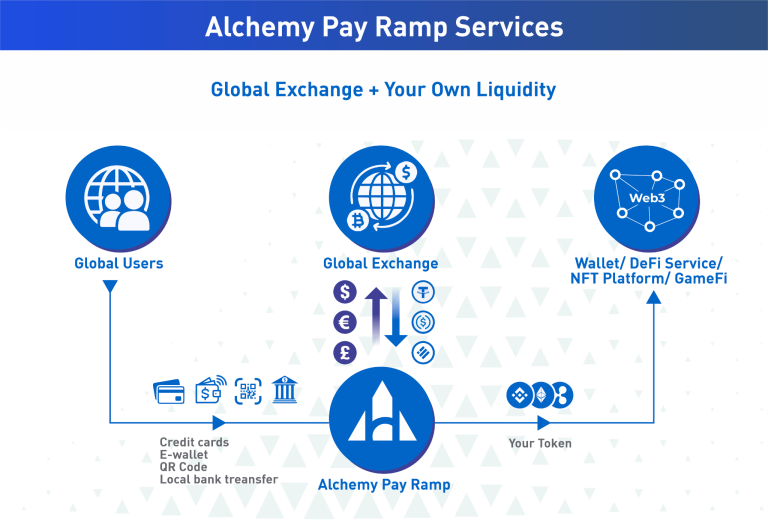

Crypto gateway protocols integrate the liquidity of fiat currency deposits and withdrawals from CEX, market makers, and other underlying sources. The deposit side integrates most third-party payment channels (PayPal, Visa, etc.) as entrances, and the withdrawal side supports fiat currencies in most countries worldwide, thus enabling one-stop trading.

Currently, crypto gateway payment protocols that have these functions include Alchemy Pay, MoonPay, Banxa, Ramp.Network, etc., but there are some differences in the breadth of payment methods and regional support, as well as the functions that can be realized.

Challenges and Hurdles in Operating a Crypto Payment Business

As mentioned above, crypto gateway products have solved some of the pain points and demand for both individual and enterprise users, and as cryptocurrencies are adopted in more scenarios, crypto payments are taking a rising market share in the payments track. However, from the nature of the crypto payment business itself, the payment products take the role of infrastructure and the industry hurdle is extremely high, making them difficult to implement. The team not only needs to have extensive experience in the payment industry to expand localized payment channels, but also needs to spend a lot of time and effort to deal with security compliance issues with varying standards in different places.

Firstly, the variations in financial development, mobile phone adoption, network availability, and electronic payment usage across different countries and regions result in significant disparities in the payment market. In this case, crypto gateways not only need to process payments on a global scale, but also need to be tailored to the specific local conditions. It is a test of the team’s ability to demonstrate proficiency in local operations while supporting global payment channels.

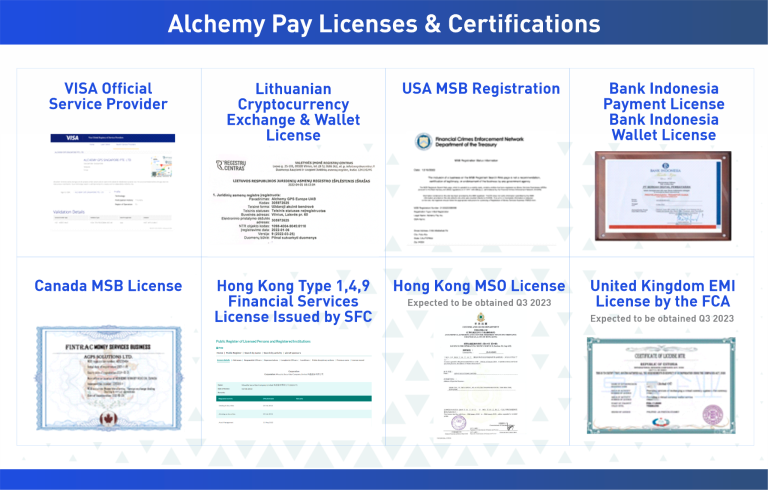

In addition, security and adherence to regulations are of utmost importance for payment products, as safeguarding users’ funds takes precedence. Despite some countries permitting cryptocurrency investments and transactions, the industry faces stringent regulatory requirements. Acquiring the necessary licenses for payment and financial services in various countries and regions is an expensive, intricate, and non-repetitive process. Moreover, the lengthy approval cycles pose a significant challenge for companies operating in the crypto payment business. Currently, less than 1% of web3 companies in the crypto payments sector hold the required licenses.

Furthermore, the crypto payment business necessitates the gateway to hold a certain amount of funds. Converting fiat and cryptocurrency funds into and out of the gateway entails a specific time delay, leading to the depositing of both fiat and cryptocurrency funds. To provide users with a seamless real-time payment experience, crypto payment gateways assume the responsibility of facilitating fiat and cryptocurrency fund advances. Without a sufficient flow of funds, maintaining the smooth operation of the payment system becomes challenging for crypto payment gateways.

In addition, technologies such as anti-fraud solutions, KYC and anti-money laundering verification are also important aspects of securing payments, and crypto payment gateways need to be fully integrated with these technologies to help improve security levels. For example, MoonPay, a leading crypto payment gateway, uses Sardine Systems to build the gateway’s security and anti-fraud foundation, and Alchemy Pay uses Forter, an e-commerce trust platform, to provide customers and users with higher payment approval rates and chargeback guarantees with the help of artificial intelligence. Another platform it works with, Sumsub, is a cutting-edge solution for user verification in the digital payments industry, which aims to provide multiple layers of protection for payments against all types of document fraud.

At present, Alchemy Pay’s Ramp product, which was introduced in June last year, has integrated and supported more than 300 payment channels. This achievement positions it as the crypto payment industry’s leader in terms of payment channel coverage, making it a highly representative and influential use case.

The company has a background as a conventional payments firm that boasts a decade-long track record. The core team members possess extensive experience, with most of them having over 10 years of expertise in various aspects of payment-related domains. Established in 2017 and headquartered in Singapore, this company has spent six years accumulating knowledge and building up its operation barrier, resulting in the establishment of a strong foothold as a crypto payment gateway. Generally speaking, it faces a wide range of roles, including consumers, merchants/enterprises, and developer users, and has a cryptocurrency-fiat mixed payment solution.

Alchemy Pay is frequently mentioned in many research articles on the crypto payment field. We will introduce Alchemy Pay Ramp in the following part to provide readers with a better understanding of the current development status of the crypto gateway field and the crypto payment industry.

What Services Can We Get Through Crypto Gateway Products?

The crypto gateway is not a new concept. Ripple, established in 2012, laid the early foundation for the development of this track. However, its cross-gateway solution could no longer meet the needs of the current market. Alchemy Pay platform has been involved in crypto gateway business since 2018, focusing on the exchange of fiat and cryptocurrency, and has established an independent deposit and withdrawal system. Other platforms that do the same business include MoonPay, established in 2019, and Ramp.Network, established in 2019 (mainly an entrance gateway).

Although OTC based on CEX is still the preferred choice for many users, we have seen that the market share of gateway products has been gradually increasing since 2018, especially as more and more users are starting to try out these crypto gateway services after many CEXs have experienced trust issues (such as FTX last year), and many users have good experiences and positive feedback.

On & Off Ramp Service

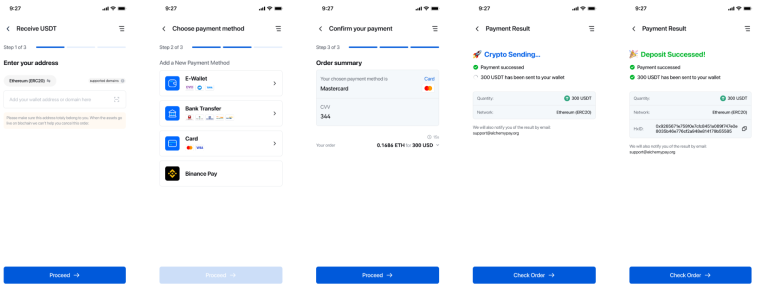

From the perspective of individual users, Alchemy Pay Ramp can be used for convenient deposits and withdrawals, where on-ramp is its main entrance for deposits, integrating Mastercard, Visa, Discover and Diners Club (credit cards, debit cards, etc.) from 173 countries, as well as SEPA wallets in the European Union and the United Kingdom, GCash in the Philippines, OVO and Dana in Indonesia, MoMo in Vietnam, PayNow in Singapore, Pix in Brazil, and some local payment providers in Peru, Chile, and Colombia.

In addition to the above-mentioned payment channels, ApplePay and Google Pay have also recently become its payment channels and can support most mainstream fiat payments (including non-US users using USD payment). It is worth mentioning that Visa has also listed Alchemy Pay as an ISO merchant (ISO-M), so the authority of Alchemy Pay in the crypto payment track is increasing, and the user group that its ramp product faces is extremely broad.

The off-ramp function supports users to exchange cryptocurrencies for more than 50 local legal currencies in over 50 countries, including USD, EUR, JPY, GBP, INR, PHP, and THB, through the above payment channels.

The highlight of Alchemy Pay Ramp is its convenience and efficiency. Its product logic is similar to that of Web2 products, and we only need three basic steps to complete deposits and withdrawals. For example, with on-ramp, the user selects the type of fiat currency to be paid and the cryptocurrency to be purchased, fills in the receiving address and selects the payment methods to complete the purchase, while with off-ramp the process is similar. Individual users can enjoy convenient and efficient withdrawals and deposits by completing a simple KYC process, and Alchemy Pay has compliance filters in place for its integrated payment channel providers.

Most gateway products currently only support custodial accounts and require platform approval to withdraw funds. Alchemy Pay Ramp supports users with a non-custodial address, which is better in terms of cost of use, efficiency and the product itself is closer to Web3. In terms of crypto purchase access, crypto gateway products have an excellent advantage in how it works and it is sure to be the main narrative of the payment field for a long time.

Crypto Payment Solutions for Enterprise Users

Aside from individual users, Alchemy Pay also provides the best support for enterprise/merchant users. These business users can directly add Alchemy Pay to their payment/receiving list using the plugins or APIs provided by Alchemy Pay Ramp, and directly use on-ramp and off-ramp to provide payment/exchange services for their users. By integrating Alchemy Pay Ramp, business users can further guarantee security, compliance, and efficiency, and reduce the potential costs of crypto payments without the need for third-party settlement and clearing institutions. Of course, this approach also reduces development costs, as adding a payment interface is extremely complex and risky from a payment perspective.

Currently, Alchemy Pay Ramp is also providing services for Web3 applications (DeFi, GameFi, SocialFi, NFTFi, etc.), supporting the direct purchase of Web3 services via local fiat currency. For example, its NFT Checkout, which is currently launched, can provide faster access to NFT for sale on NFT-related platforms and makes it easier for users to purchase NFT. Its partners currently include LooksRare, Vega, etc. In addition, Alchemy Pay has also established partnerships with networks such as Polygon, Avalanche, Algorand, and Arbitrum, and these ecological applications and developers are expected to receive support from Alchemy Pay Ramp.

Safeguarding Funds Through Compliance

Crypto gateway products usually need to obtain compliance support because they become the direct place for the exchange of cryptocurrencies and fiat currencies. Most gateway products currently have made certain breakthroughs in compliance.

For example, Alchemy Pay has a wide layout in some areas with more potential for the development of cryptocurrencies, including Europe, Hong Kong, Singapore, Canada, South Korea, Japan, and holds licenses such as Type 1,4,9 Financial Services License issued by SFC of Hong Kong, Canada and United States MSB license, the license from the Central Bank of Indonesia to operate remittances and fund transfers, and Lithuanian Cryptocurrency Exchange & Wallet License. It also indirectly obtains compliance support through cooperation with some local payment providers in Southeast Asia, Latin America, and other regions. In addition to Alchemy Pay, many other projects that play in the same field, such as MoonPay, Ramp.Network, Banxa, etc., also perform well in compliance.

The promotion of the compliance of crypto gateway products has a great promoting effect on the adoption of cryptocurrencies in payments, especially when it can give high support on the risk control (such as Alchemy Pay achieve high-intensity anti-fraud and risk control through Forter), and the acceptability of cryptocurrencies will be greatly improved.

Crypto Payments Industry Backed by Blue Ocean Market

The crypto payment industry is a blue ocean market space. According to Euromonitor International’s report on the global payment market, the current global payment scale exceeds 175 trillion US dollars, and commercial payment amounts account for a high proportion. Currently, the number of cryptocurrency holders is exponentially increasing every year, approaching 300 million people in the current, and these users are expected to become potential users of crypto payments. Therefore, based on these facts and with the continuous improvement of the crypto payment infrastructure, crypto payments are expected to enter a period of rapid development in the future.

From another perspective, cryptocurrencies are becoming the “lifesaver” for users in high inflation areas, such as Southeast Asia, Africa, and Latin America. These users maintain a high enthusiasm for cryptocurrencies and intend to use cryptocurrencies to reduce financial risks. Overall, these regions are potential markets for crypto payments, and the crypto attempts in El Salvador and the Central African Republic are undoubtedly revolutionary. We have reason to believe that economically underdeveloped regions have stronger demand for cryptocurrencies and greater potential.

Currently, Alchemy Pay has a high penetration rate in these regions, especially in the Latin American and Southeast Asian markets,and offers a more competitive service through access to more localized channels.

In the future, with the further improvement of crypto technology (such as ZK, flow payments, etc.) and the introduction of relevant crypto regulations, crypto payments may become an indispensable and important part of our lives, and will form a deep complementarity with traditional payments.

This is a sponsored post. Learn how to reach our audience here. Read disclaimer below.

Bitcoin News

Leave a Reply

You must be logged in to post a comment.