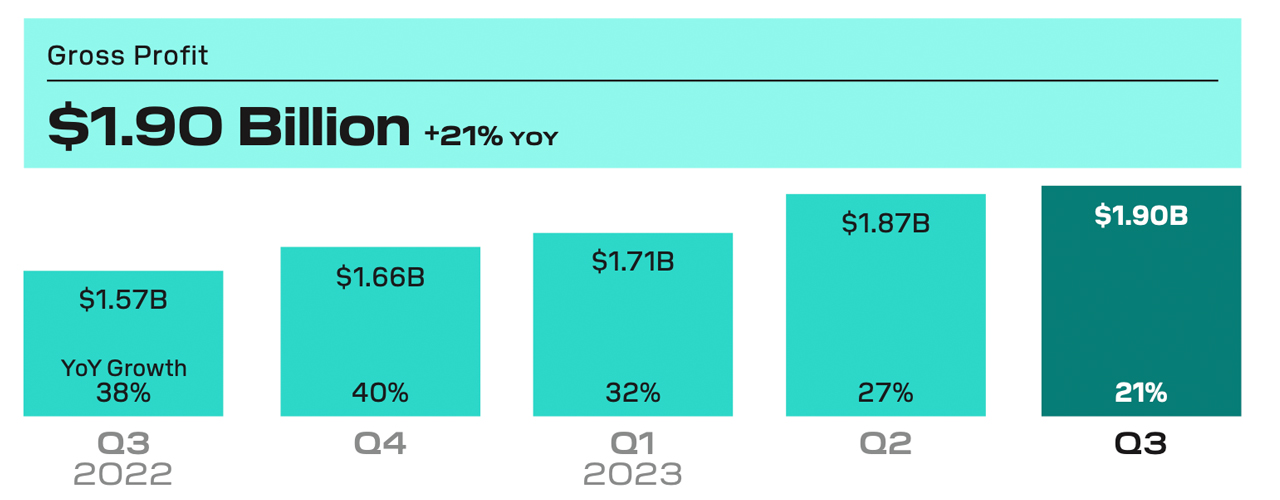

Block Inc. reported an increase in third-quarter earnings, with total net revenue climbing to $ 5.62 billion, marking a 24% year-over-year growth. Setting aside its bitcoin operations, the company’s revenue saw a jump to $ 3.19 billion, up 16% from the previous year. The firm’s shareholder letter discloses that bitcoin revenue rose to $ 2.42 billion, underscoring the crypto asset’s swelling impact on the company’s profits.

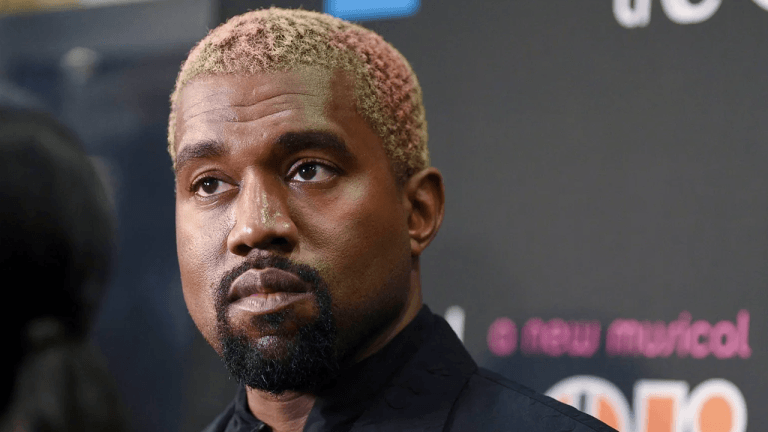

Block Targets ‘Rule of 40’ by 2026 After Reporting Q3 Earnings and Cash App User Expansion

Jack Dorsey’s Block, Inc. published a shareholders’ letter disclosing the firm’s Q3 earnings. The letter reveals that the Block has advanced its investment blueprint, noting an uptick in third-quarter profitability. The Block has revised its full-year 2023 forecasts upward for both Adjusted Operating Income and Adjusted EBITDA.

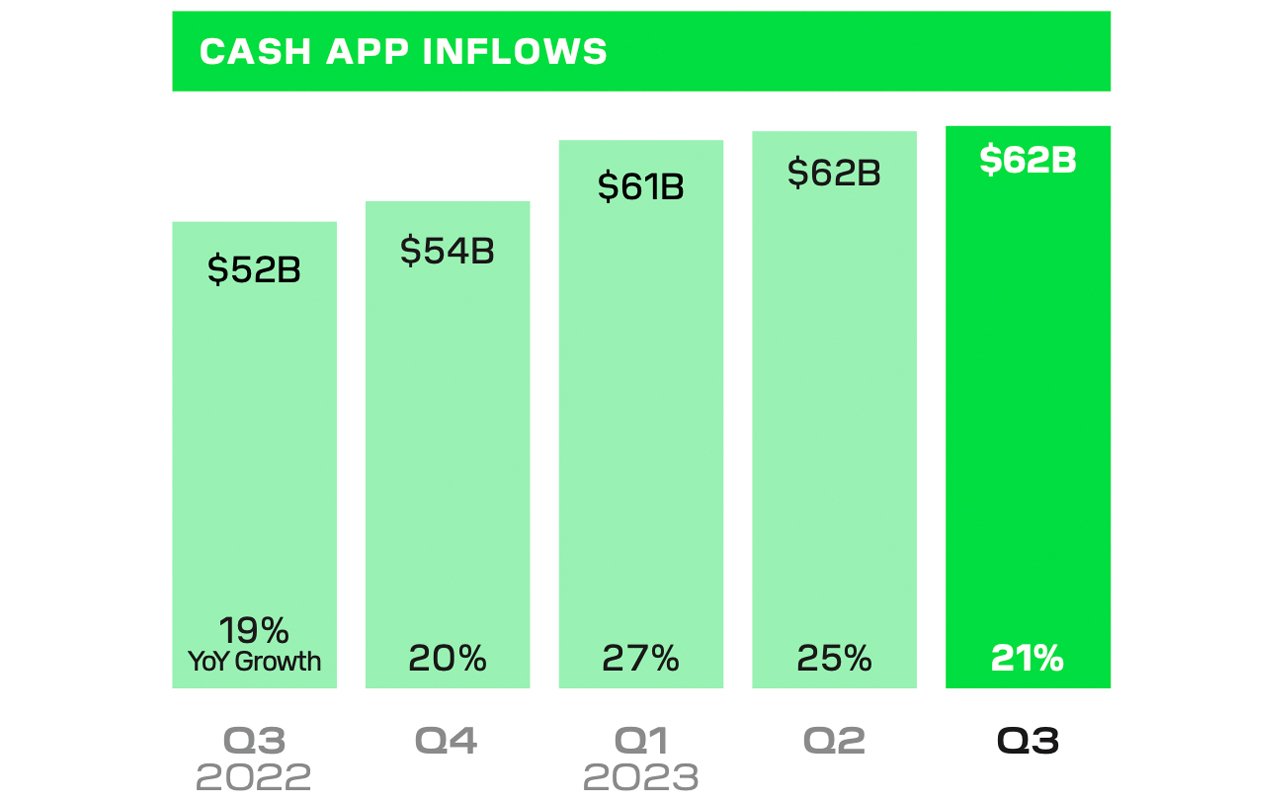

The Block has also shared that Cash App Pay transactions have risen in recent months. By September, the service recorded over two million monthly active users, a figure that has doubled since June. The report reveals a substantial rise in bitcoin revenue for Q3, climbing to $ 2.42 billion, a 37% increase from the previous year.

Likewise, Bitcoin’s gross profit ascended to $ 45 million, marking a 22% year-over-year gain. The company is initiating a first-time authorization to buy back $ 1 billion of its shares, countering some dilutive effects of share-based compensation. The Block’s Q3 shareholder letter states:

We believe we will reach Rule of 40 in 2026, with an initial composition of at least mid-teens gross profit growth and a mid-20% Adjusted Operating Income margin.

The Block’s Q3 earnings follow Coinbase’s third-quarter financial disclosures which show the firm also prospered with net profit. Microstrategy also unveiled its Q3 earnings, revealing additional bitcoin purchases made in October.

The Block’s shareholder letter further mentions a cap of staff members as the firm will not hire any more than 12,000 employees. The Block will not hire any more staff members until they feel the business has “meaningfully outpaced the growth of the company.”

The Block maintains bitcoin (BTC) as an asset on its balance sheet and disclosed investments of $ 50 million in the final quarter of 2020 and $ 170 million in the initial quarter of 2021 into bitcoin.

Since bitcoin is classified as an indefinite-lived intangible asset, it’s susceptible to impairment losses when its market value dips below its book value within the evaluation period. However, in the third quarter of 2023, the Block reported no impairment losses on its bitcoin holdings.

What do you think about the Block’s Q3 earnings report? Share your thoughts and opinions about this subject in the comments section below.

Bitcoin News

Leave a Reply

You must be logged in to post a comment.