In the wake of Texas Governor Greg Abbott’s latest declaration, emphasizing Texas’ inherent constitutional right to defend itself and pointing to the Biden administration’s lack of enforcement of federal immigration statutes, the rhetoric around a potential “national divorce” or “civil war” has gained momentum on social platforms. This leads us to explore a theoretical situation in which the United States faces a second Civil War, focusing on the ramifications for the U.S. dollar.

How a Second U.S. Civil War Could Reshape the Dollar’s Value

The discussion of a potential second Civil War has intensified following a statement from Texas Governor Greg Abbott, asserting that the federal government is neglecting its responsibilities to secure the border. “The federal government has broken the compact between the United States and the States,” Abbott explained in the letter published on Jan. 24. “The Executive Branch of the United States has a constitutional duty to enforce federal laws protecting States, including immigration laws on the books right now. President Biden has refused to enforce those laws and has even violated them. The result is that he has smashed records for illegal immigration.”

Incredible how 4 years of Biden’s governance has resulted in two new wars and the groundwork for a civil war. https://t.co/qSXl22AhE9

— Carl Benjamin (@Sargon_of_Akkad) January 25, 2024

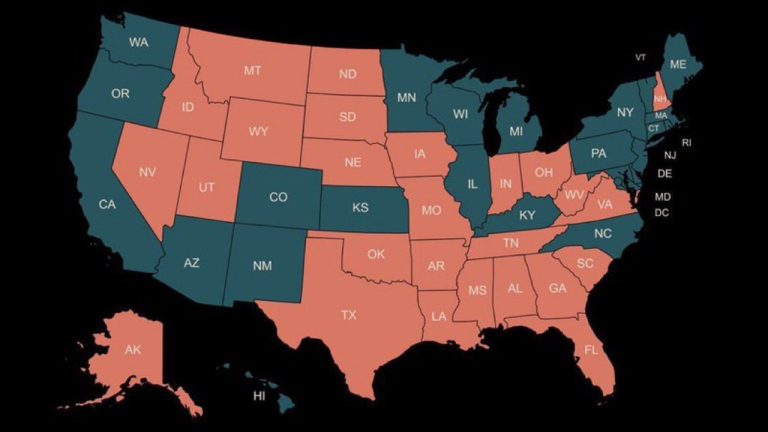

This statement came on the heels of persistent disagreements between the Texas state authorities and the Biden administration over immigration enforcement. Following the statement, a coalition of 25 U.S. governors rallied behind Texas, in opposition to the federal government. This development has sparked extensive discussions across social media platforms, with terms like “civil war” and “national divorce” becoming trending topics on X. A civil war, in reality, would profoundly affect the U.S. dollar. Initially, it might trigger a decline in trust in the fiat currency.

Civil War shouldn’t be trending. Revolution should be.

— DR. ETIQUETTE

(@DrEtiquette) January 26, 2024

The value of a currency is heavily dependent on the political stability of its issuing country, and a civil war could severely weaken the global standing of the dollar. Although the exact consequences of a second civil war in the U.S. are uncertain, historical insights from the nation’s first civil war and conflicts in other countries provide some context to this hypothetical situation. For example, Lawrence W. Reed, a member of the Foundation for Economic Education (FEE), has detailed the economic consequences of the Civil War spanning 1861 to 1865 in a thorough account. Reed notes in his editorial that a free-for-all of federal spending continued well after the Civil War.

Reed writes:

For half a century from 1865 until World War I, the federal government ran an almost unbroken string of budget surpluses. Today, it produces trillion-dollar deficits without batting an eye, and the President demands trillions more in spending and debt.

Reed highlights that the Civil War basically led to “disastrous hyperinflation in the Confederacy and considerable currency depreciation of paper greenbacks in the North as well.” In another scholarly study, Roger L. Ransom of the University of California explains that with the onset of the war, the North effectively turned into a currency-producing powerhouse, issuing double the amount of currency compared to the South. Concurrently, the federal government accumulated billions in debt for the first time in history.

Should a civil war recur, leading to an expansion in currency issuance, the influx of dollars in the economy, not matched by an increase in goods and services, would devalue the dollar. Beyond the inflationary challenges confronting the greenback, variations in regional currencies could emerge. In such a civil war context, various U.S. regions might adopt their own currencies or monetary systems, adding complexity to the economic environment and reducing the prominence of the current U.S. dollar as the standard national currency.

Refuge in Borderless Assets

A potential second civil war in the U.S. might significantly benefit borderless assets and herald a global shift towards alternative assets. Approximately 65 countries anchor their currencies to the U.S. dollar, and it serves as the official currency of exchange in five U.S. territories and 11 foreign countries. Consequently, any disturbances to the U.S. dollar could create a global ripple effect, prompting individuals worldwide to seek refuge in alternative forms of economic value. In the event of instability in the U.S. dollar, alternative assets like gold, various foreign currencies, and cryptocurrencies might find increased favor as people look for stability beyond the American currency.

It is important to understand that these potential consequences are speculative, drawing from historical patterns and economic principles. The real effects of a second U.S. civil war would hinge on the particularities of the conflict, how the international community responds, and the actions of global financial institutions and governments. Yet, despite the conjectural nature of this scenario, the existing political divide in the U.S. is remarkably deep. Presently, Americans find themselves more ideologically polarized than they have been in over twenty years.

What do you think about the civil war discussions happening in America right now? Share your thoughts and opinions about this subject in the comments section below.

Bitcoin News

Leave a Reply

You must be logged in to post a comment.